[Below is a transcription of the podcast]

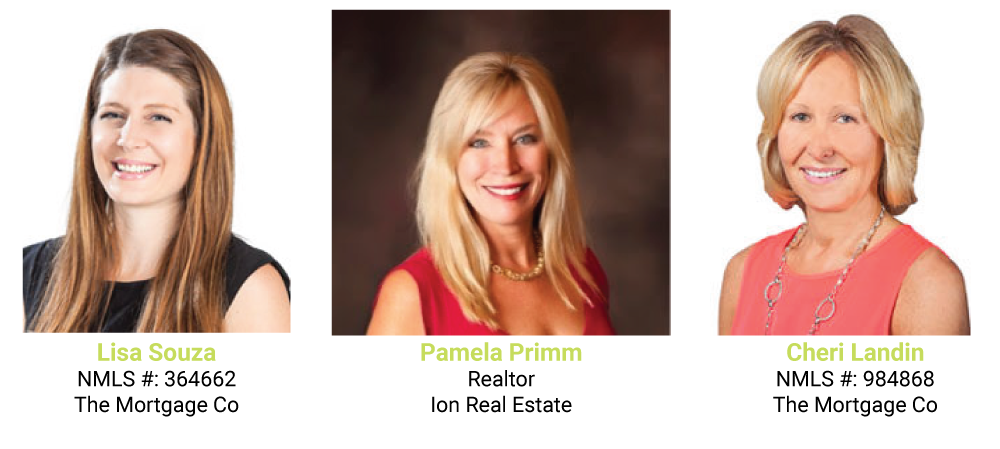

Cheri Landin: Hello and welcome to our buying versus renting podcast. This show is for people who are new to Colorado and are ready to buy and for first time homeowners out there. Are you ready to buy but don’t know what price point you should be looking at? Do you wonder what parts of town you should look at? Not sure how much money you will need or what financing options are out there? What is the process? Well that is exactly what we will be talking about today. My name is Cheri Landin and I am the Community Development Director for The Mortgage Company. The Mortgage Company has been providing residential mortgage loans for over 20 years and they’re based right here in Centennial, Colorado. As the community development director, one of my role is to bring relevant information to our communities such as what we will be covering in this podcast today. With me I am joined by Pamela Primm of Ion Real Estate as well as Lisa Souza from The Mortgage Company. So I am going to have them introduce themselves. So Pamela if you would.

Pamela Primm: Hi this is Pamela Primm. I am with Ion Real Estate and I’m excited to be a part of this podcast because I really enjoy helping first-time homebuyers, especially younger people that love Denver and want to move here. My background is pretty extensive in the real estate industry. I have been in the industry about 20 years in different capacities. I’ve been a residential realtor. I was fortunate to work on site for a builder and a developer so I’m good at helping with selection of interior components things like that. I also sold home warranties, so that gives me the opportunity to be knowledgeable with the systems and things that are in the home that might be covered by a home warranty. And I also sold title insurance. So with that kind of combination of all different aspects of the industry I am very knowledgeable and I am dangerous enough to know a little bit about mortgage but that is why I work with Cheri and Lisa from The Mortgage Company because they’re the experts.

Cheri Landin: Great. Lisa if you can go ahead and introduce yourself that would be great.

Lisa Souza: Thank you so much. So my name is Lisa Souza and I am the branch manager at our uptown office in Denver. I’ve been in the business a little bit over 10 years and with The Mortgage Company for almost seven of those years. I really loved this company a lot. We have a great owner who is in the office every day and we really specialize in finding the right loan solutions to meet each individual borrower’s needs. One of my most satisfying parts of my job is working with buyers to buy their first home.

Cheri Landin: Great. Thank you Lisa and Pamela. Knowing who we are, let’s just get right into it. Denver and the surrounding communities are growing at a rapid rate. We all see that. There’s cranes and construction pretty much at every street corner. And traffic has become unreal. I think that we would all agree on. And I don’t think this will be slowing anytime soon, if we look at all the statistics. And so that being the case, how do we determine what the right time is to buy real estate and why would we want to buy real estate. We know there are some benefits of owning. Number one, you just naturally are building equity. When you are renting 100 percent of your payment is going to a landlord. However, when you own a portion of that is going and building equity immediately for you. There’s price appreciation in the Denver area. So over the last 20 years, the average annual increase in price for properties is 5.36 percent. And over the last five years, which has had accelerated growth, it is averaged at 9.26 percent. So clearly between the combination of building equity and price appreciation there’s dollars that are in your pocket and not someone else’s. Rents are increasing. Clearly with such an influx of population into Denver, the demand is very high for rents because people don’t necessarily know where they want to purchase right away. And that is one of the reasons too and one of the biggest questions we have; people moving into the area and have rented for a year now where can they go? They’re tired of putting money in someone else’s pocket. Interest rates are still very low which gives you a little bit more buying power which we will get into. And then there’s also some potential tax benefits. So with that. Pamela, what are the average rents in the area right now.

Pamela Primm: That’s such a good question Cheri and it does fluctuate honestly quarter to quarter because people are moving here so quickly. To kind of speak to your point that you said earlier, it is not surprising that Colorado has had such an influx of people because currently they have the nation’s lowest unemployment rate of only 2.3 percent. So many millennials continue to flock here. Average rent, like I said, depends on the occupancy rate of the different apartment buildings. They do have the opportunity to adjust their pricing depending on their financial needs and how occupied they are. For example, in July the average rent for all unit sizes meaning Studio 1 bedroom, 2 bedroom that was $1591. That’s up .19 percent over last year. So you are correct, obviously that the rent continues to increase. The average one bedroom rent is about $1500 a month. And that is up 1.91 percent from last year. Two bedroom rent averages about $2000 a month. So you are spending a lot of money to not own anything. And the other thing to consider when you are renting versus buying is the additional costs involved. When you sign a lease for an apartment: first, last, security deposit, most of them require. Many of them have an extra monthly fee for parking. I know everybody in Denver loves their dogs. The pet deposit can be big at a lot of apartment complexes. In most cases not refundable. So just talking about that it makes a ton of sense to begin to build your future, begin equity and then an extra fun thing about homeownership is you have the opportunity to make it your own. Decorate it, if you have a little yard you can plant in and that is a nice feature because things you improve in your own home are yours and permanent. So that is one reason why ownership is much more valuable than buying.

Cheri Landin: Great thanks, Pamela. All right. So let’s just go ahead and take that two-bedroom average rental rate at $2000 a month. Lisa, if you can talk to that. So assuming that $2000 a month how much home can you actually buy if you want to keep your monthly payment about the same.

Lisa Souza: Thanks, Cheri. When I hear a number like that I think a lot of people might share my shock to think that the search for just a two bedroom condo or apartment that somebody else owns that and it could be that costly to live there. I think a lot of people would be surprised to learn that generally speaking that $2000 range was actually very little down, potentially. You could be looking at a single family somewhere in the neighborhood of $300000. That can buy a lot in some neighborhoods and I think Pamela can maybe speak to some areas where that might be available. And then you know for those of you that that like condo living, not having to worry about fixing things on your own and things like that. For a condo in that price range even including your homeowner’s association dues, I could probably find something in that 250-275 thousand dollar range. And again this is something that you own, your building equity, and there are some potential tax benefits.

Cheri Landin: Great thanks, Lisa. That actually is I think one of the biggest questions people have is how do you equate that monthly payment, what you paid rent, and what does that look like in a property. So that’s great. If we say $2000, let’s just take the single-family home, would be a $300000 home. That’s amazing. Next, we need to take that to: “All right, where can we find those $300,000 homes?” Pamela, can you give us some areas around in surrounding the Denver metro market that might equate to that.

Pamela Primm: Yes. While there’s not a lot on the market, that price point is certainly achievable. I looked up some statistics just for today and between $200,000-$300,000, there were 460 units or properties on the market in single-family residences. And that is just speaking of the data today with regard to the RE Colorado MLS site. I call central Denver kind of all the way from Westminster. It’s not necessarily central I’m going off the i25 corridor, so you can kind of stay fairly close to that I-25 corridor both east and west and that price point from Westminster down through Englewood. And certainly, there’s a lot of properties available in Arvada, Aurora, Greeley, north. There’s a lot of bargain more value up there as you travel out of the central area. But it is competitive but certainly, there are a lot of properties available in Thornton, Westminster kind of the North area is pretty hot for that price point. And then like I said Aurora, farther out into Lakewood. It’s not a ton but just today there’s 460 on the market. So really there’s plenty of choices when you’re at that price point.

Cheri Landin: Great. Thanks, Pamela. There’s actually quite a few communities there and I think that’s a little bit of a misconception that people are just thinking Denver and Denver alone. There are areas outside of the central area as Pamela just stated that there are properties available. I also do know that typically a lot of the properties were you know sold the day they were listed and now it’s a little bit more. They can be on market for about a week and that may not sound like much but it really does give the buyers a little bit more time to get in there and be a little bit competitive. So thank you for that Pamela. So this all sounds great. I can buy a home let’s say at that price point. There are communities that support that price point for homes. Now I’ve got a problem, Lisa. What if I haven’t saved that much money for a down payment. Do I have any options?

Lisa Souza: Yes absolutely, and that’s the top thing I hear often times when I’m hearing a conversation or I’m asking people are you thinking about buying or why haven’t you bought yet? Downpayment seems to be kind of at the forefront of what people perceive to be the biggest obstacles to homeownership. It’s really not so. We are a CHFA approved lender and also have a couple of other down payment systems programs at our disposal. People might be surprised to learn that you can get into a home and pay that $300,000 range with very very little out-of-pocket by utilizing one of these down payment systems programs. They’re not just limited to first-time homebuyers. Although first-time homebuyers can definitely benefit from them as well. But just to give you an example of that $300,000 price range for a single family home, general estimating the payment right around $2000 including taxes, insurance, with a minimum 3% down and getting down payment assistance to cover a portion of that, your estimated cash to close can be anywhere from around $2000 to $2500 maybe even less. That’s without asking for seller concessions. So I would just urge anybody even without down payment assistance or even without a lot of money in the bank to talk to us because we may have a solution for you to get a home now, sooner than later.

Cheri Landin: Great thanks. And Lisa if you would, saying CHFA, we in the room know what CHFA is, but if you would can you explain what that is and what someone may need to do if there are any requirements for qualifying for some of these assistance programs, what the buyer has to do, can do, just a little bit about what that is and how that works. If you would.

Lisa Souza: Sure thing. Us mortgage people love our acronyms. So, CHFA is the Colorado Housing and Finance Authority and they’re here in Colorado specifically to help people obtain homeownership. And they do that by providing reduced mortgage insurance rates, competitive interest rates, and those down payment systems that I mentioned a little bit ago. Basically how you qualify for one of those programs is you talk to me, we talk about your details. There are some income and property location parameters that have to be met but it’s really available to just about everybody. Again not just limited to first-time homebuyers. And then CHFA is not the only option. I think a lot of people would be surprised to hear that 3 percent down is really the minimum down payment for a standard conventional loan and then not with FHA which is a government insured loan. That required downpayment is just 3.5%. Those funds don’t have to be your own. They can be gifted. So again lots of options in terms of different loan programs for all different situations.

Cheri Landin: Great. Thanks. And you mentioned CHFA and FHA which are great programs. How about what’s out there for our wonderful veterans.

Lisa Souza: We love doing VA loans, love helping out veterans and a VA loan is really one of the best out there. Basically, a VA loan is a benefit for our veterans. That allows them to do 100 percent financing with no mortgage insurance. So typically on a typical conventional loan say you would have to pay private mortgage insurance on anything over 80 percent loan to value. But with a VA loan they require no down payments, so 100 percent financing. Closing costs, everything can be rolled in. So really a great benefit for our veterans to help them with homeownership. The interest rates on VA loans are also really really attractive.

Cheri Landin: Great thanks, Lisa. And I think it’s a wonderful benefit and not enough people know about it. If any of you are veterans in any capacity, actively serving, in the reserves, any type of affiliation with our military branches, it’s definitely something worth looking into. So thank you, Lisa. So, Pamela, we talked a little bit about that maybe homes are on the market a little bit longer today. But can you just kind of go over some of them, for instance how quickly are properties selling right now? Maybe what is the average amount of days on market in particular property types? And how does that work? For instance, the average amount of time it takes for a buyer when they go under contract, meaning all parties have signed and agreed on that purchase price until the date that we can actually move in.

Pamela Primm: Well that’s a great question because I think when people first begin their search for a home, they don’t quite understand all the time frames and contract deadlines. So statistically July of 2016, the average days on the market were 18. July of 2017, it’s 23. However, as you said earlier Cheri, sometimes the places hit the market and they have offers five minutes before the first open house. So it just depends on what is available at that current time frame. You might have 50 three bedroom, two bath homes available on Wednesday in a certain area and then on Friday, there’s only 30. The average days on market is 18 from last year and 23 from this year. It’s getting a little bit easier for a buyer to take a tiny bit more time. In terms of when we go under contract to when the property closes. Most sellers, they want to close and they won’t get the funds out of their property to usually, in most instances, they need that money to move on to the next property. The average time frame is about 45 days. Certainly, you can make it quicker if you have people that are in a hurry. It depends on the title company, if there’s anything that might come up on a title policy or if you guys at The Mortgage Company see something that might need fixing or a document that might be adjusted, it can take a little longer, but 30 to 45 days is the average time. Other things that are involved, once you do go under contract. You have the opportunity to get a home inspection which I highly encourage and recommend. How that works is within a certain timeframe, we like to do that fairly quickly after we get under contract, the buyer hires at their expense of building inspector. It’s a really interesting thing to learn about. That building inspector will go through every aspect of your home: the brick and mortar, the appliances, the roof, etc. and just do an overall evaluation of the condition of the property. In some instances, they also do what’s called a radon test. So they’ll place a radon testing machine in the home to test the air quality and that can take 24 up to 48 hours is the average. Then sometimes people want a sewer scope where a video camera goes out into the street to see the condition of the sewer. All three of those are considerations and then you get the reports back and the buyer has the opportunity to ask the seller to fix things or perhaps a credit at closing, etc. So we have to factor that into the time frame. Also, the title company has to run the title search to make sure that the property is free and clear and actually ready to sell. So with no glitches 30 to 45 days, 60 I would say is the longest an average seller would take and they don’t generally like that if somebody needed to get a property sold that’s rare. It’s quick because Denver is such a popular area to live.

Cheri Landin: Great. Thank you, Pamela. OK, so there is a lot that happens once you go under contract. And I think that I’m going to ask you, Lisa, to speak on that from the loan side. There’s a lot of different components to a real estate contract and the financing piece is in and of itself its own little animal that has a lot of moving parts that most people are unaware of. Lisa if you could maybe talk about that loan process from a timeline perspective and if you want to speak a little bit about what Pamela spoke about the inspection and title searches that we need to do. Also one of the things that I know that we require here at The Mortgage Company is having an appraisal. If you can speak to that because that typically is one of the things that takes the longest time. So that would be great if you could.

Lisa Souza: Yes, definitely like Pamela said once you once you get under contract there is a lot to think about which is one of the reasons I stress with my clients and why I think it’s so important to get the financing pre-approved ahead of time. There are definitely some things that we can do upfront to make the process a lot more streamlined, a lot quicker and definitely less stressful once you are under contract. Here at The Mortgage Company, I’ve seen contracts for 60 days but they are few and far between. I would say in my experience what I’m seeing most of is a 30-day contract and even some a bit shorter than that. We at The Mortgage Company have a closing guarantee. If we miss your closing date we pay a thousand dollars. So we really really pride ourselves on adhering to the dates in the contract and making sure that we get you to closing on time and without delays. So part of the way that we can help ensure that happens is to get you pre-approved before you even go out there looking and in fact, a lot of sellers actually want you to be. In fact, most sellers want you to be fully pre-approved before they’ll even consider your offer. So basically how that looks is we meet or we talk, we get your details, we discuss your parameters, what you’re looking to achieve. We’ll get you some estimates so you have an idea of what the what the numbers might look like in your given price range. Then we collect all your information and get it in front of an underwriter for official review and sign off. What that means is that once you have that pre-approval, there’s really only property specific conditions remaining things like homeowners insurance, earnest money and of course the appraisal. Speaking to the appraisal, that’s kind of another thing in the market right now that is causing some delays and some headaches for buyers out there. We have a dwindling pool of appraisers out there, especially here in Colorado, and so it can sometimes be very difficult to get an appraisal scheduled right away and get the appraiser in there right away. We at The Mortgage Company have a kind of a nice little benefit. We actually run our own appraisal management desk which basically means that the gal that is scheduling our appointments or appraisals and working with the appraisers to get them done by the dates that we need, works in our office. She works for The Mortgage Company and is obviously motivated like the rest of us to make sure those due dates are met. I would say right now the average appraisal time is running about three weeks although oftentimes we’re able to get that done much sooner again by running our own appraisal or appraisal desk, that helps.

Cheri Landin: Great thanks, Lisa. Pamela, I know you have a little bit more information that you’d like to share.

Pamela Primm; Yes I just wanted to go over when people say, “Where do I want to live?” I always encourage people to drive neighborhoods, to drive them at different times of the day, different days of the week. Everybody wants something different. An interesting website that a lot of my clients I direct them to is called Walk Score.com. You can put in your zip code and then it’s going to get a score telling you where the Light Rail is and stuff like that. So it’s a neat place to find out, if you do like walking neighborhoods, how it’s rated. When people ask me, certainly I have a ton of data for them. But the best thing for them to do is to go and experience the neighborhood and see if it’s right for them and the family.

Cheri Landin: Great. Thanks, Pamela. OK so I know there are a lot of information that was shared. I think some of the takeaways are, clearly if buying is something that even is a thought in your mind, it’s probably time to just start doing your homework and a little due diligence. As Pamela mentioned, check out some neighborhoods but I think first and foremost if anyone wants to purchase they really need to talk to a lender and just make sure that if there’s anything that’s going to get in the way or if there’s anything that needs to be planned for, that it’s done upfront before you start looking for properties. In all of this information it’s it’s you know a major investment, it’s a major purchase, and a lot of this can be very overwhelming for people. So myself and Lisa and Pamela, we all want to be here to support you and answer any questions that you may have. We’ve learned that if you are remotely thinking about purchasing the time to get started is now and just with the process. One of the things that we are offering to in addition to this podcast is we are going to be doing first-time homebuyer seminars which will be held at Ion Real Estate, at Pamela’s real estate office which is downtown Denver. Details will be on the website. Please find us at www.themortgageco.com to get started. This is where you’ll find links to any pertinent information that you may need and also find all our contact information. Please reach out. We want to thank you so much for listening. Let us know how we can help and I hope you all have a fabulous day.

Presented By: